Accountants in public practice, commerce and government often miss legitimate deductions — or accidentally claim items the ATO regularly knocks back. Here’s a simple, practical breakdown you can share with clients or team members. Common Deductible Expenses Professional memberships & registrations CA ANZ, CPA, IPA, AAT, TPB — must relate to current employment. CPD, seminars…

We’ve just completed the Top 20% benchmark for Art Galleries, and the difference between average operators and the best in the industry is striking. The top performers blend curatorial skill with strong commercial discipline. They run a gallery like a business, not a passion project. Here’s what the best look like: Revenue: $700k–$1M COGS: 40–45% Wages: 10–20% Rent: 5–10% Net…

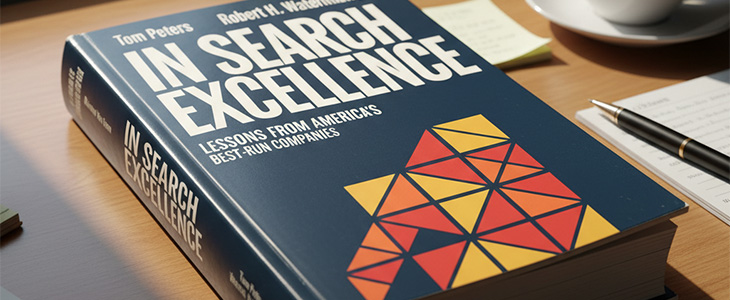

I revisited In Search of Excellence recently. Written in 1982, but the core message still cuts through: Stop comparing yourself to the average. Look at what the best are doing — and learn from them. Peters pushed leaders to ask better questions: Who’s winning? What are they doing differently? What can we apply? That mindset helped…

Accounting practices in Australia are most often valued using a multiple of maintainable earnings (EBIT or EBITDA) — with goodwill making up 70–90% of the total value. 1. The Core Method: Earnings Multiple Example: EBITDA $500,000 × 4x multiple = $2.0 million value Practice Type EBITDA Multiple Small suburban (1–2 partners) 2.0x – 3.0x Medium-sized (advisory mix) 3.0x – 4.0x…

In the 1990s, Michael Hammer challenged the business world with Business Process Reengineering (BPR) — the idea that incremental improvement wasn’t enough. He argued that to stay competitive, organisations had to redesign their processes from the ground up. Simply automating old workflows wasn’t transformation — it was entrenching inefficiency. Hammer’s insight: “Don’t automate. Obliterate.” At the heart of his…

“My clients won’t be interested in benchmarking.” Let’s be honest, that’s what most accountants think. The truth? Clients are very interested once they see what benchmarking actually means for their bottom line. Most business owners have never seen how they stack up against the top 20% in their industry. But once they do, it flips a switch.…

We’re expanding the power of TaxFitness again. Our new Business Valuations Database is now live in early access — covering 80 industries today and growing to 400+ industries over the next month. Accountants can now generate indicative business valuations instantly by industry, providing a powerful new way to: Benchmark a client’s business value in seconds…

When people talk about quality, they often mention W. Edwards Deming. But Joseph M. Juran deserves equal credit and perhaps more relevance for accountants today. Juran’s idea of “fitness for use” reminds us that only the customer decides whether our work truly adds value. Reports, systems, and advice mean little if clients don’t find them useful. He also gave…

Many accountants and business owners avoid it — not because it doesn’t work, but because of a few persistent myths that limit performance and growth. Myth 1: “Benchmarking is only for big businesses.” Truth: Benchmarking is actually more valuable for small and medium businesses. These businesses operate with tighter margins, smaller teams, and less room for error. They often…

After World War II, Deming travelled to Japan to teach manufacturers a revolutionary idea — that quality is measurable, and improvement is continuous. Through statistical process control, he showed companies like Toyota how to reduce variation, identify waste, and build excellence into every process. His philosophy of continuous improvement — later known as Kaizen — and his 14 Points for Management changed…

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2