TaxFitness has just launched a major upgrade combining AI-powered business strategy recommendations with benchmarking across 400+ industries. 𝗛𝗲𝗿𝗲’𝘀 𝘄𝗵𝗮𝘁’𝘀 𝗻𝗲𝘄 𝗮𝗻𝗱 𝗽𝗼𝘄𝗲𝗿𝗳𝘂𝗹 💪 𝗕𝗲𝗻𝗰𝗵𝗺𝗮𝗿𝗸 𝗮𝗴𝗮𝗶𝗻𝘀𝘁 𝘁𝗵𝗲 𝘁𝗼𝗽 𝟮𝟬% 𝗼𝗳 𝗯𝘂𝘀𝗶𝗻𝗲𝘀𝘀𝗲𝘀 𝗶𝗻 𝘆𝗼𝘂𝗿 𝗰𝗹𝗶𝗲𝗻𝘁’𝘀 𝗶𝗻𝗱𝘂𝘀𝘁𝗿𝘆 Upload your client’s numbers and instantly compare KPIs like: • COGS • Wages • Rent • Subcontractors • Overheads •…

Even in firms that already offer tax planning, I see the same mistake over and over again. They only offer it to a few clients they think are the “ideal” candidates. The result? Clients miss out on strategies that could save them thousands. The practice misses out on revenue it should be earning. It’s like Woolworths deciding to…

We’ve just released a major suite of upgrades to help you deliver higher-value, tailored, and more strategic advice to your clients. 1. Custom report titles Rename reports to match your client’s exact needs: – Asset Protection Report – Top 20% Benchmarking Report – Family Group Tax Strategy – Wealth Report – Profit Optimisation Plan You choose the title to make every report…

TaxFitness is excited to announce a new partnership with AccountanXY. Marketing coaching, training, and resources for industry disruptors! Successfully marketing your services and standing out from the crowd of same-same accountants is the answer you’ve been looking for. Discover how to gain the unfair advantage in your firm this year! Learn more about AccountanXY here.

TaxFitness is excited to announce a new partnership with The Boss Factor Library, the unbelievably easy way to grow your people and your business. Learn more about The Boss Factor Library here.

We’ve just launched one of our most powerful upgrades yet. You can now import financial data directly from QuickBooks and MYOB into TaxFitness. No more manual entry Reports in minutes, not hours More time for strategy, clients, and billable work If you’ve been waiting for the right moment to return, this is it. Book a free demo…

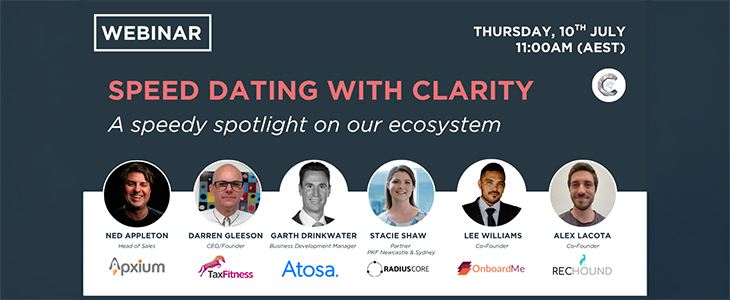

Most accountants are open to new tools, but let’s be honest, you don’t have time to sit through five demos, chase follow-ups, and decode sales speak. So here’s the shortcut. Clarity speed dating Thursday, 10 July at 11:00 AM AEST 5 Presentations × 6 minutes each No slides. No fluff. Just five sharp sessions with…

Founder of TaxFitness, Darren Gleeson’s new book ‘The Tax Planning Advisory System’ is out now! A practical 10-step framework for accountants looking to deliver high-value, strategic tax planning advice and scale a profitable advisory service. Used by 500+ accountants $2,000+ advisory engagements delivered in minutes Fully branded client-ready reports To celebrate the launch, anyone who…

It was a pleasure to connect with our expert software partners, IntuitiveIT, over a productive lunch in Melbourne on Thursday. Our close collaboration is central to enhancing the TaxFitness platform, ensuring we continue to deliver the most innovative and efficient tax planning solutions for our accounting members. We’re dedicated to empowering accountants with the best…

TaxFitness is excited to announce a new partnership with Practice Protect, the largest cyber security platform trusted by over 28,000+ accounting professionals. Protect your clients’ data and put your security on autopilot with our all-in-one, managed-for-you platform. Trust us with your cyber security and focus on being your clients’ trusted advisor. Find out more about…

"You can’t improve what you don’t benchmark"

- W. Edward Deming