Where lost salary return fees will, and won’t be replaced

When salary return numbers drop, the obvious question is:

“Where does that revenue get replaced?”

For some firms, it won’t be.

If your firm’s value is tied to checking receipts and lodging forms, there’s no natural upgrade path. The work just disappears. But for firms that understand advisory, the shift is straightforward.

The $1,000 standard deduction becomes the opening line:

“Great — now let’s look at what actually matters.”

That leads into:

- Occupation-specific deductions most people never claim

- Asset and usage strategies around cars, home offices, tools and equipment

- Investment and business structures

- Forward-looking tax planning, not last year’s clean-up

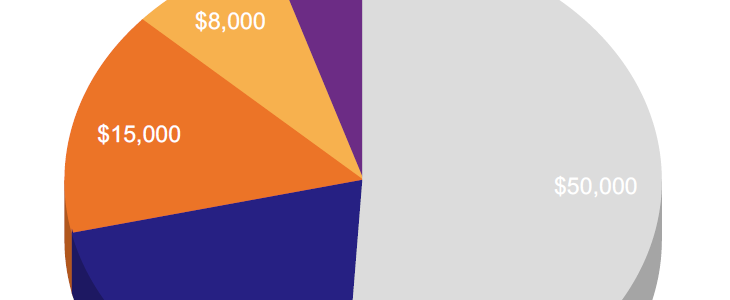

The lost $200 salary return isn’t replaced by another $200 job.

It’s replaced by:

- A $1,500 planning engagement

- An annual advisory package

- Ongoing work tied to decisions, not compliance cycles

This is why some firms will shrink while others grow, even with the same client base. The $1,000 deduction doesn’t remove demand for accountants. It removes demand for low-value work. What replaces it depends entirely on whether a firm is prepared to move upstream, or stay where the margins keep getting thinner.

The shift has already started. 1 July 2026 just puts a date on it.

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2