Tax Planning Strategy 99 | Art

Small businesses buying art prior to 30th June 2017 with a purchase cost of less than $20,000 (excluding GST) are entitled to a full tax deduction. The art can be enjoyed at the small businesses office, warehouse, farm, or home office. There are no restrictions on the type of art or the number of pieces purchased.

After 1st July 2017 the upfront deduction is only available for individual art pieces costing less than $1,000 each. Where art costs more than $1,000 the asset will instead go into the general pool and be depreciated at 15% in the first year of purchase, and 30% per year after that.

Irrespective of the arts purchase price, all GST registered businesses are entitled to claim an input tax credit back on the purchase price (where the artist or gallery charged GST on the sale). This means the ATO is effectively funding 1/11 of your upfront cost.

Art in the workplace has been proven to reduce stress, increase productivity, improve communication and stimulate creative thinking. In a recent survey 82% of employees said art was important in their work environment, and 73% said they would change employers if the art were removed. In addition, art is a great investment and has produced long term annual capital gains of 4-5% over the last 465 years.

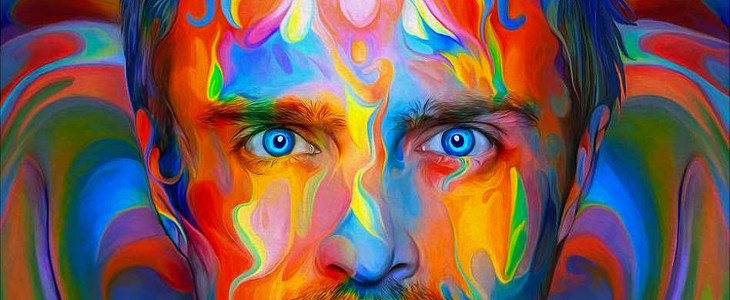

Art In Our Community with Robert Ewing

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2