Capital city: Andorra la Vella Currency: Euro (EUR) Population: 77,281 Language: Catalan GDP: …

This strategy is about using your private vehicle to operate an Uber business and make additional income (whilst at the same time making your private vehicle expenses tax deductible). Deductible Uber business expenses include: Fuel Registration Insurance Repairs, tyres and maintenance costs. Depreciation on the car purchase cost. Car purchase cost (if less than $20,000)…

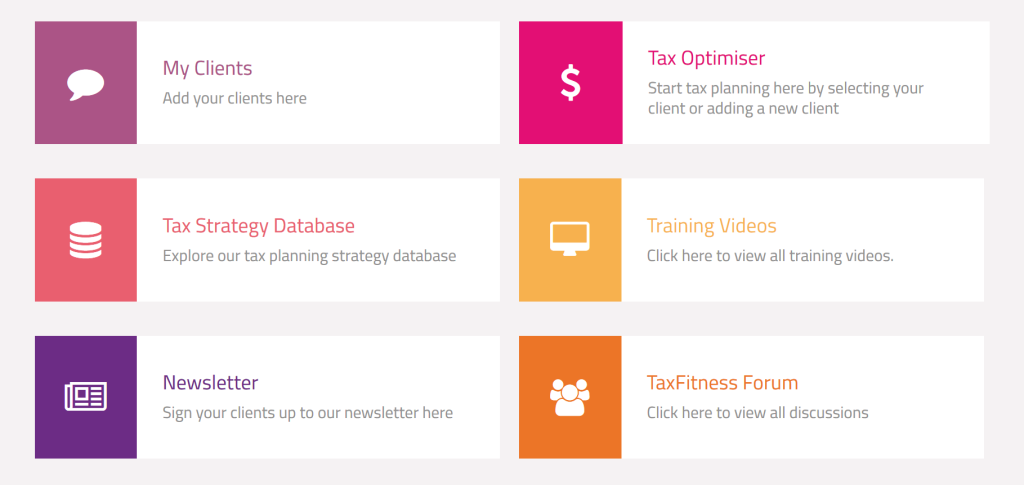

We are excited to announce a new and advanced / improved / upgraded version of TaxFitness! Branding You can now remove the TaxFitness logo and branding from your Tax Savings Reports and add your own brand colours quickly and easily as a practice manger from My Practice. Integrated Mud Map We have integrated the Client…

Average weekly pay: $1,400 Employment size: 188,100 Future growth: Strong Skill level Bachelor Degree or Higher Accountants provide services relating…

A candle is an ignitable wick embedded in wax, fat, tallow or another flammable solid substance. They have been used throughout history for light, heat, fragrance, aesthetic value and sometimes to tell the time. The earliest candles originated in Han China around 200 BC and were made from whale fat. By the 13th century, candle…

Fugitives often use tax havens as a refuge when fleeing from jail, government arrest, government or non-government questioning, vigilante violence, or outraged private individuals. When hiding from law enforcement agencies taking refuge in a different country makes sense. Tax haven countries can be attractive to fugitives as they: Are easy to enter and gain residency. Have…

Average weekly pay: $700 Employment size: 2,500 Future growth: Decline Skill level Certificate III or IV A blacksmith is a…

Objectives: Simon Jones operates a metro based private investigator business providing investigatory and surveillance services. When Simon visited his accountant, he said he was concerned about potential legal claims from unhappy individuals they had investigated on behalf of clients. Facts: $260,000 gross fee income. $80,000 business wages, contractors and overheads. Single. Current tax…

The Plantagenet Kings of England had the medieval right to require Maritime towns and counties to furnish them with ships in times of war. This duty was sometimes commuted for money, which became known as ‘ship money’. Ship money was unique as it was one of the few taxes the Monarchy could levy without the…

Corruption is a form of dishonest or unethical conduct by a person entrusted with a position of authority, often to acquire personal benefit. Government or political corruption occurs when an office-holder or other governmental employee acts in an official capacity for personal gain. Corruption creates the opportunity for increased inequality, reduces productivity, growth, investment and…

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2