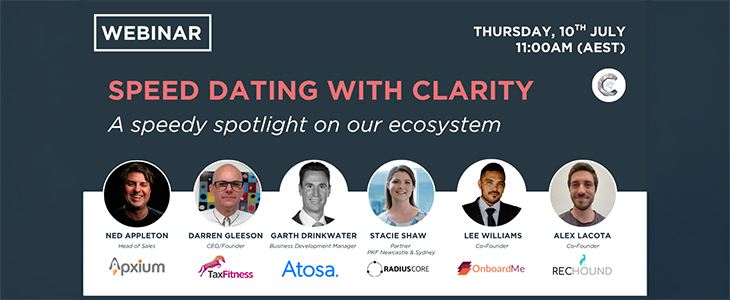

Most accountants are open to new tools, but let’s be honest, you don’t have time to sit through five demos, chase follow-ups, and decode sales speak. So here’s the shortcut. Clarity speed dating Thursday, 10 July at 11:00 AM AEST 5 Presentations × 6 minutes each No slides. No fluff. Just five sharp sessions with…

Self-paced tax planning manual (100 pages). Marketing manual (30 pages). Marketing templates, brochures, and materials (30+). Checklists, pricing guides, templates (15+). Training videos – Tax planning, benchmarking and business advisory (10+) – more coming. 3 hours 1-on-1 training on software, pricing, marketing, etc. All complementary and part of the annual subscription (Only $1,320 pa).…

Public practice accountants are missing huge opportunities – simply because they focus too much on compliance work. BAS, tax returns, and financial statements are essential, but they’re just the bare minimum. Imagine two dentists: Michael only does cleanings, fillings, and scaling. Steven offers all of that – plus whitening, veneers, crowns, and root canals. Who’s…

According to a study by the Australian Securities and Investments Commission (ASIC), around 50% of Australian adults do not have a will. In Australia, if a person dies without a valid will, their estate is considered intestate. Intestacy laws then come into effect to determine how the deceased person's assets will be distributed. The specific…

Tax incentives for taxpayers: Personal income tax rates reduced. The personal income tax rates that were to apply from 1st July 2022 are brought forward to 1st July 2020. These changes involve: Increasing the upper threshold of the 19% personal income tax bracket from $37,000 to $45,000, and Increasing the upper threshold of the 32.5%…

The 10% of practices that currently provide tax planning services to their clients generate annual fees revenue of $284m. This book has been written for the 28,968 accounting practices in Australia (the 90%) that aren’t currently providing tax planning services to their clients. The first part of the book talks about why your clients need…

Our Taxfitness tax strategy database now boasts 250 tax strategies to help your clients structure their affairs to legally reduce their tax liability and make savings. The database explains how 250 different tax strategies actually work (i.e. what the tax strategy is, when to use the strategy, average tax deductions created by the strategy, and the strategy…

34 practices in Melbourne and Perth have just completed our Tax Planning Made Simple Workshop. The workshop teaches practices how to add a tax planning division to their practice in only one day. Although tax planning generates $330 million of fees pa, less than 1% of practices outside the top 100 generate any tax planning revenue. …

Tax Savings for 201 Employee Occupations details tax saving strategies and ideas for 201 different employee occupations. It doesn’t matter what the occupation is, there are tax strategies that commonly apply to that occupation. Often employee taxpayers are unaware of all the tax saving strategies that are available. This is understandable as the Australian taxation…

Frank Genovesi’s new tax planning book shows how a home business can offer significant and lasting business, taxation, wealth and lifestyle benefits. Get your copy here through Amazon.

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2