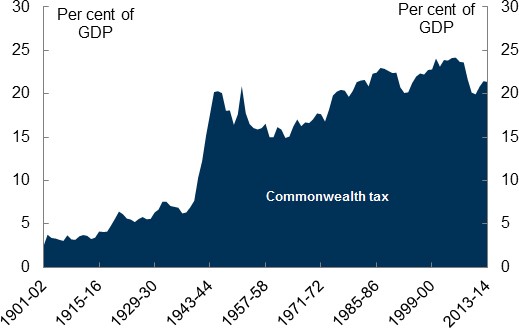

1942 – Commonwealth Takes Over Income Taxes

5 July 2017

The Commonwealth legislated that their income tax take priority over any State income tax and that any State retiring from income tax collection be paid a grant in compensation for lost revenue. The States rejected this tax takeover but the High Court ruled that the Commonwealth income tax legislation was valid, essentially giving the Commonwealth constitutional priority in taxation.

The States were not precluded from superimposing their own income taxes on top of the Commonwealth tax, but if a State did so its Commonwealth tax reimbursement payment would cease. As the Commonwealth income tax rates were set at a level which made it difficult for the States to raise an amount equal to Commonwealth tax reimbursements they retired from the field of income taxation.

Posted in Blog

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2