2026 Growth blueprint for ambitious firms Presented by: Ange Macdonald and Ben Hayden-Smith Invitation-only Masterclass Exclusive. Join us who will be sharing how to: What actually needs to change inside a firm for advisory to work Why marketing alone doesn’t fix advisory problems How firms can move from ideas to action without overwhelming their team…

We are thrilled to announce our latest partnership with FBT Salary Packaging Solutions. By teaming up with Australia’s leading FBT specialists, we are bringing you exclusive, custom training designed specifically for the industry. Whether you are in Accounting, Finance, Payroll, or HR, this is your opportunity to upskill with training delivered by the best in…

We are thrilled to officially welcome Andrew Robertson and TwentySix Group as our newest TaxFitness strategic partners. At TaxFitness, our mission is to turn compliance accountants into high-valued advisors. Partnering with industry leaders who share that vision and have a proven track record of making it a reality is crucial to our continued growth. Andrew…

When salary return numbers drop, the obvious question is: “Where does that revenue get replaced?” For some firms, it won’t be. If your firm’s value is tied to checking receipts and lodging forms, there’s no natural upgrade path. The work just disappears. But for firms that understand advisory, the shift is straightforward. The $1,000 standard…

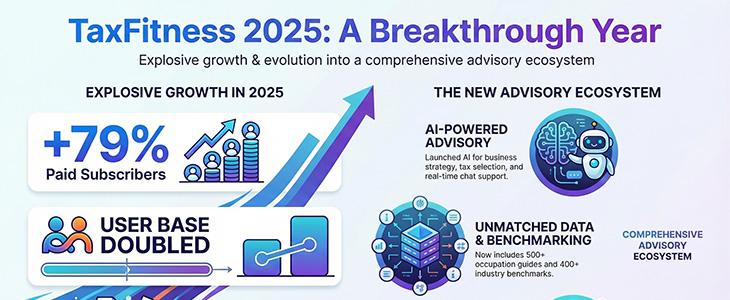

As we close out 2025, I wanted to share where TaxFitness has landed and, more importantly, where we’re heading. This year has been the biggest step forward we’ve taken since the platform launched. Not just more users. Not just more features. A genuine shift in how accountants deliver advice. 𝗛𝗲𝗿𝗲’𝘀 𝘁𝗵𝗲 𝘀𝗻𝗮𝗽𝘀𝗵𝗼𝘁: Paid subscribers up…

A quick but important update. The occupation deductions advisory system inside TaxFitness has just been expanded again. We now have 501+ occupation deduction fact sheets live in the database, with more being added every week. Every single fact sheet follows the same clear, accountant-friendly structure: What clients in that occupation can legitimately claim What they can’t ATO risk areas to watch…

Art supplies retailing is one of those industries where owners work hard, the shelves are full, the shop feels busy… and yet the bank account tells a completely different story. But the Top 20%? They play a totally different game — and the numbers prove it. Here’s where the best operators sit: Revenue: $800k–$1m COGS: 45–50% Wages: 15–20%…

Quick update — the new occupation deductions advisory system is now live inside TaxFitness. We’ve loaded 300+ occupation fact sheets, and we’re pushing this to 500+ by Christmas 2025. Every sheet tells you exactly what employees in that industry can claim — and what they can’t — so you can give clients clear, confident answers without digging through the…

There are plenty of benchmarking tools out there — but most fall short when it comes to helping accountants deliver real, high-impact advice. They’re often: Too generic Too complex Too focused on averages that don’t inspire action That’s why we built the TaxFitness Top 20% Business Benchmarking System — purpose-built for accountants, bookkeepers, BAS agents, and business advisors who…

Book a business benchmarking demo in October or November and receive a FREE copy of our book, ‘The TaxFitness Top 20% Business Benchmarking System‘, a proven framework for accountants to deliver high-value advisory services.

"You can’t improve what you don’t benchmark"

- W. Edward Deming