Too many accountants ask me the same question: “How do we actually turn tax planning and advisory into real revenue — not just nicer reports?” Here’s the honest answer. Software alone doesn’t do it. Neither does a one-off webinar or a template download. What works is guided execution, applying the work with real clients, refining it,…

Most accountants underestimate one of the easiest wins sitting right in front of them: Occupation-specific tax advice. Generic deduction lists don’t cut it anymore. Clients want clarity, not guesswork — and they want to know you understand their world, not just “tax rules”. That’s why we built the TaxFitness Occupation Deductions Database — now covering…

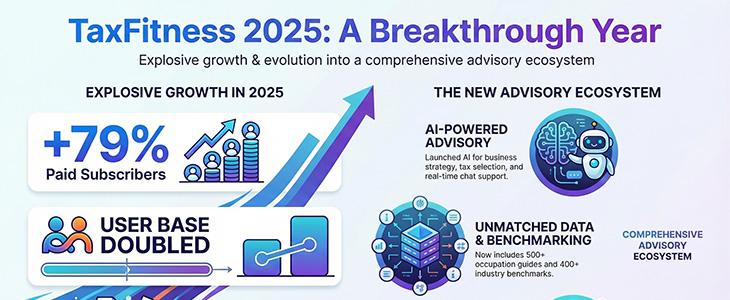

As we close out 2025, I wanted to share where TaxFitness has landed and, more importantly, where we’re heading. This year has been the biggest step forward we’ve taken since the platform launched. Not just more users. Not just more features. A genuine shift in how accountants deliver advice. 𝗛𝗲𝗿𝗲’𝘀 𝘁𝗵𝗲 𝘀𝗻𝗮𝗽𝘀𝗵𝗼𝘁: Paid subscribers up…

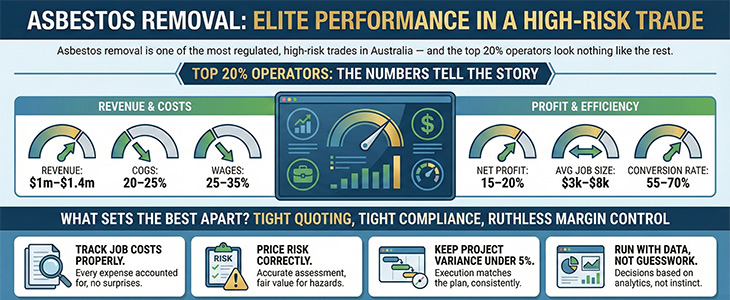

Asbestos removal is one of the most regulated, high-risk trades in Australia — and the top 20% operators look nothing like the rest. Their numbers tell the story: Revenue: $1m–$1.4m COGS: 20–25% Wages: 25–35% Net profit: 15–20% Avg job size: $3k–$8k Conversion rate: 55–70% What sets the best apart? Tight quoting, tight compliance, and ruthless…

Most accountants know the name Philip Crosby — the man behind “zero defects” and the famous line: “Quality is free.” It sounds bold, but Crosby was right. Doing things properly the first time is always cheaper than fixing mistakes later. Every practice owner has learned that lesson the hard way. But here’s the part that often gets missed:…

A quick but important update. The occupation deductions advisory system inside TaxFitness has just been expanded again. We now have 501+ occupation deduction fact sheets live in the database, with more being added every week. Every single fact sheet follows the same clear, accountant-friendly structure: What clients in that occupation can legitimately claim What they can’t ATO risk areas to watch…

Art supplies retailing is one of those industries where owners work hard, the shelves are full, the shop feels busy… and yet the bank account tells a completely different story. But the Top 20%? They play a totally different game — and the numbers prove it. Here’s where the best operators sit: Revenue: $800k–$1m COGS: 45–50% Wages: 15–20%…

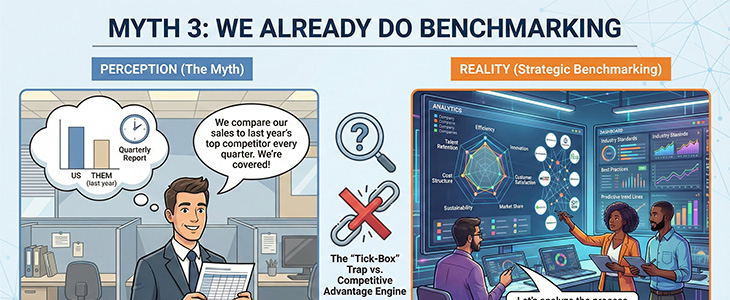

I hear this every week from accountants. And here’s the truth: KPIs on their own are just numbers. They only become meaningful when compared to a higher standard. W. Edwards Deming said it best: “No process is ever good enough unless it is compared to a higher standard.” Most firms track KPIs in isolation: Gross…

Harvard’s Michael Porter is the godfather of strategy. Competitive advantage. Five forces. The value chain. Every accountant has heard the buzzwords… but here’s the uncomfortable truth: Most firms read Porter, nod wisely — and then keep giving clients average numbers. Porter would absolutely hate that. His whole message was simple: Competitive advantage happens when you break down the…

Quick update — the new occupation deductions advisory system is now live inside TaxFitness. We’ve loaded 300+ occupation fact sheets, and we’re pushing this to 500+ by Christmas 2025. Every sheet tells you exactly what employees in that industry can claim — and what they can’t — so you can give clients clear, confident answers without digging through the…

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2