At Federation in 1901, the Australian Constitution granted the Commonwealth a monopoly of customs duties and excises and the power to levy other taxes concurrently with the States. One of the significant results of Federation was the removal of all duties on goods traded between Australian states. By Federation, many of the colonies had introduced…

Tasmania was the first state to introduce an income tax in 1880 to raise revenue due to a fiscal crisis. The tax took the form of a withholding tax on distributed income of companies. In 1884, a general tax on income was introduced in South Australia, and in 1895 income tax was introduced in…

The first direct taxes took the form of taxing the estates of deceased persons which at the outset applied only to personal estates and not real estate. The first death duty was applied in 1851 in NSW, 1865 in Tasmania, and eventually all the other states by 1901. The rates were progressive and based on…

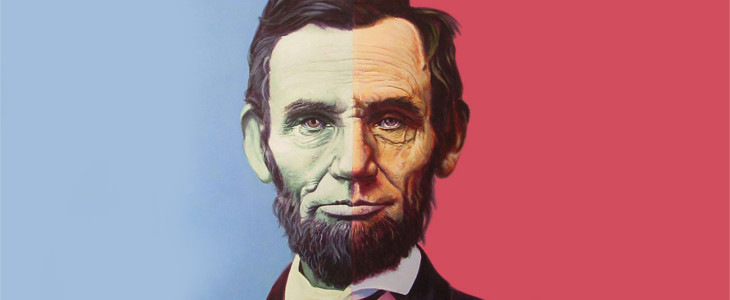

The US federal government imposed the first personal income tax, on August 5, 1861, to help pay for its war effort in the American Civil War – (3% of all incomes over US$800). It was only in 1894 that the first peacetime income tax was passed through the Wilson-Gorman tariff. The rate was 2% on…

Paying our legal taxes is a small price to pay for the benefits we enjoy in a privileged, prosperous, and safe society such as Australia. The great majority of taxpayers, individual and corporate, pay their taxes voluntarily and in accordance with the law. Smart taxpayers focus on maximising their legal tax savings whilst ensuring 100%…

Illegal tax saving strategies damage the fabric of society and Government policy is clearly to minimise or eliminate them. If tax avoidance is left unchecked, the perception of unfairness has the potential to undermine the voluntary ethic in the broader tax system. Every accounting practice in Australia will have at least a couple of clients…

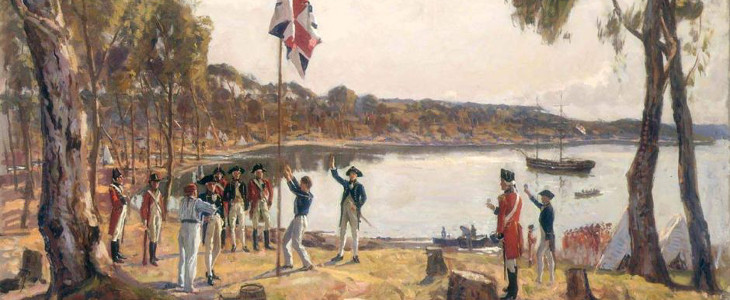

The English navigator James Cook became the first European to map the east coast of Australia in 1770 and a First Fleet of British convicts followed to establish a penal colony at Sydney in 1788. When the first Governor, Governor Phillip, arrived with the First Fleet he had a Royal Instruction that gave him power…

As the well-known Australian billionaire media magnate Kerry Francis Packer once said in reference to the Australian government, ‘Now of course I am minimising my tax and if anybody in this country doesn’t minimise their tax they want their heads read because as a government I can tell you you’re not spending it that well…

Income tax was first implemented in Great Britain by William Pitt the Younger in his budget of December 1798 to pay for weapons and equipment in preparation for the Napoleonic Wars. Pitt’s new graduated (progressive) income tax began at a levy of 2 old pence in the pound (1/120) on incomes over £60 (£5,696 as…

Willie Hugh Nelson (c1933-) is an American musician, singer, songwriter, author, poet, actor, and activist. The critical success of the album Shotgun Willie (1973), combined with the critical and commercial success of Red Headed Stranger (1975) and Stardust (1978), made Nelson one of the most recognized artists in country music. He was one of the…

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2