The First Self Managed Super Fund was Established in 1915

A self-managed super fund (SMSF) is an Australian trust structure that is used by members to personally manage their retirement savings. SMSFs are established for the sole purpose of providing financial benefits to its beneficiaries in retirement, with the benefits passing to the deceased’s beneficiaries on death.

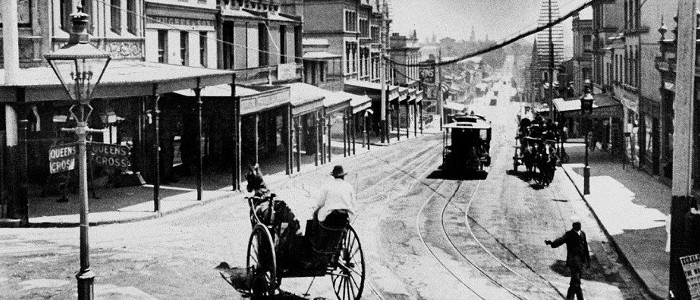

The first SMSFs were established in 1915 to take advantage of the original tax exemption for super funds in the 22-page Income Tax Assessment Act 1915. Of course, with the First World War in full swing, only a few small business owners took the steps to become eligible for that first tax exemption for super funds. With the rewrite of the income tax assessment act in 1936 (ITAA 1936), employer super funds continued to enjoy the tax exemption. The Act was subsequently amended a few years later to extend the tax exemption to super funds established for the benefit of self-employed persons (with less than 20 self-employed members).

The modern SMSF emerged in October 1999 from the former regime for ‘excluded’ funds (ie funds with fewer than 5 members). Australia has over 600,000 SMSFs with another 30,000 being established each year. Taxpayers are attracted to SMSFs due to the members ability to control their money, diverse investment options, and low tax rates (0%, 10%, or 15%). The 1.1 million SMSF members control over $700 billion in assets, with the ‘average SMSF having $1.2 million of assets.

The Australian Taxation Office is the key regulator of SMSFs, and assists with compliance of the obligations under the law. All super funds in Australia are required to comply with the SIS Act (Superannuation Industry [Supervision Act] 1993) which is the superannuation act and statutory bible.

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2