Book a business benchmarking demo in October or November and receive a FREE copy of our book, ‘The TaxFitness Top 20% Business Benchmarking System‘, a proven framework for accountants to deliver high-value advisory services.

We’ve just released a major suite of upgrades to help you deliver higher-value, tailored, and more strategic advice to your clients. 1. Custom report titles Rename reports to match your client’s exact needs: – Asset Protection Report – Top 20% Benchmarking Report – Family Group Tax Strategy – Wealth Report – Profit Optimisation Plan You choose the title to make every report…

We’ve just launched one of our most powerful upgrades yet. You can now import financial data directly from QuickBooks and MYOB into TaxFitness. No more manual entry Reports in minutes, not hours More time for strategy, clients, and billable work If you’ve been waiting for the right moment to return, this is it. Book a free demo…

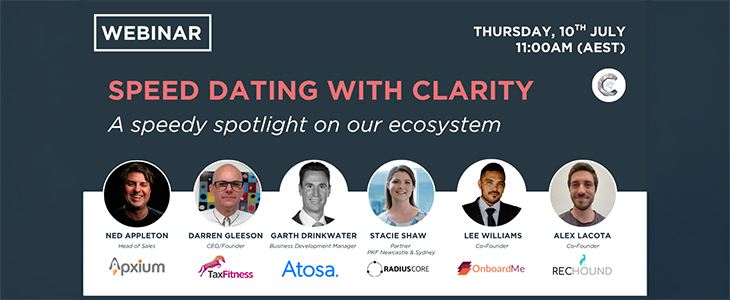

Most accountants are open to new tools, but let’s be honest, you don’t have time to sit through five demos, chase follow-ups, and decode sales speak. So here’s the shortcut. Clarity speed dating Thursday, 10 July at 11:00 AM AEST 5 Presentations × 6 minutes each No slides. No fluff. Just five sharp sessions with…

Founder of TaxFitness, Darren Gleeson’s new book ‘The Tax Planning Advisory System’ is out now! A practical 10-step framework for accountants looking to deliver high-value, strategic tax planning advice and scale a profitable advisory service. Used by 500+ accountants $2,000+ advisory engagements delivered in minutes Fully branded client-ready reports To celebrate the launch, anyone who…

It was a pleasure to connect with our expert software partners, IntuitiveIT, over a productive lunch in Melbourne on Thursday. Our close collaboration is central to enhancing the TaxFitness platform, ensuring we continue to deliver the most innovative and efficient tax planning solutions for our accounting members. We’re dedicated to empowering accountants with the best…

Darren Gleeson presents 2 one one-hour tax planning bootcamp webinars. Getting started with tax planning | Monday 5th May 10:30 AM – register now. Educating & selling tax planning to clients | Tuesday 6th May 10:30 AM – register now. Implementing tax planning strategies | Wednesday 7th May 10:30 AM – register now. See all…

If you’re still only offering tax compliance services, you’re leaving serious money on the table. Included in your TaxFitness annual subscription, the self-paced tax planning course shows you exactly how to unlock an extra $30,000+ in fees in your first year—without adding a single new client. Here’s what you get: Proven 10-step process to deliver…

Self-paced tax planning manual (100 pages). Marketing manual (30 pages). Marketing templates, brochures, and materials (30+). Checklists, pricing guides, templates (15+). Training videos – Tax planning, benchmarking and business advisory (10+) – more coming. 3 hours 1-on-1 training on software, pricing, marketing, etc. All complementary and part of the annual subscription (Only $1,320 pa).…

Why AI tax planning is a game-changer Access 250+ proven tax strategies AI scans a vast, legally compliant database to find the best ways to reduce your clients tax burden. Custom-tailored to your situation. No one-size-fits-all! AI analyses your clients real financial data to match strategies to their goals, income and business. More than just…

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2