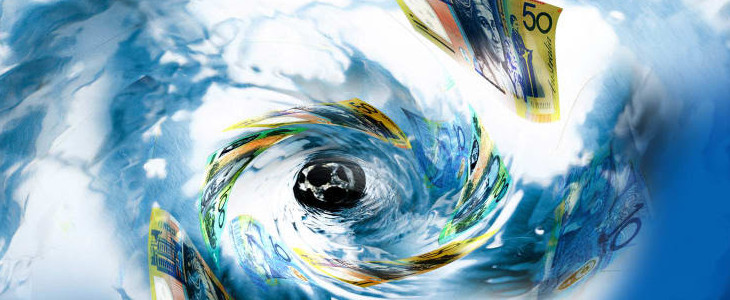

Avoiding Capital Gains Tax

Since 1985 Australia has had a capital gains tax that taxes residents on their capital gains made on property and share investments. Various exemptions apply, with the main one being the primary residence exemption.

In contrast, non-residents investing in Australian only pay capital gains tax on Australian property. Taxable Australian property includes:

- A direct interest in real property situated in Australia

- A mining, quarrying or prospecting right to minerals, petroleum or quarry materials situated in Australia

- A capital gains tax asset used in carrying on a business through a permanent establishment in Australia

- An indirect interest in Australian real property. Owning a minimum 10% of an entity where the value of the interest is principally attributable to Australian real property.

This means non-residents can invest in Australian shares and pay no capital gains tax in Australia. Australian governments have relaxed the tax burden on foreign investors to increase Australia’s attractiveness as a destination for foreign capital.

In 2006, a consortium of investors (including private equity investor TPG), acquired the shares in Myer for approximately A$1.4 billion. In 2009 the shares in Myer were then offered for sale under an initial public offering (IPO) and TPG realised a gain of A$1.5 billion. As the two TPG companies selling the Myer shares were domiciled in tax havens (NB Queen SARL in Luxembourg and TPG Newbridge Myer Limited in the Cayman Islands), no tax was payable in Australia, or overseas.

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2