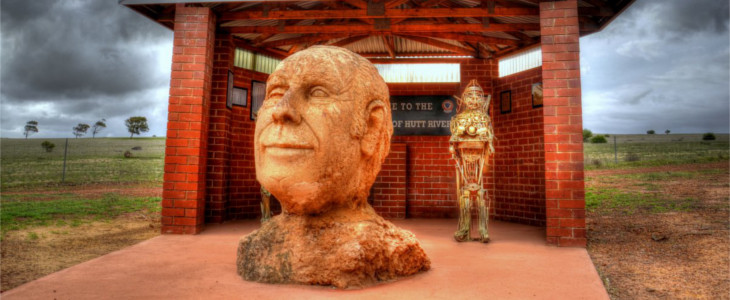

Principality of Hutt River

Capital city: Nain

Currency: Hutt River Dollar

Population: 23

Language: English & French

GDP Unknown

The Principality of Hutt River is a micronation in Australia that is located 517 km north of Perth, near the town of Northampton in the state of Western Australia. The micronation was founded on 21 April 1970 by Leonard Casley, who declared his farm to be an independent country under the name Hutt River Province. This claim has been rejected by both the Australian Government and the High Court of Australia. The Principality of Hutt River is a regional tourist attraction, and issues its own currency, stamps, and passports.

On 15 February 1977, Casley was successfully prosecuted for failing to comply with requirements to furnish the Australian Taxation Office (ATO) with required documents. In 2006 Casley was again successfully prosecuted by the ATO. In 2016, the ATO once again prosecuted Casley for tax offences (which are ongoing).

The province levies its own income tax of 0.5% on financial transactions by foreign companies registered in the province and personal accounts. While the principality maintains it does not pay taxes, the Australian government’s current official position is that it is nothing more than a private enterprise operating under a business name. Since 2 September 2004, Hutt River Province/Principality has accepted company registrations. Concerned that Hutt River registrations “may be sold as part of a tax avoidance or evasion arrangement”, in April 2012 the Australian Taxation Office warned potential purchasers that the registrations have no legal basis and “could be illegal”.

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2