Since 1985 Australia has had a capital gains tax that taxes residents on their capital gains made on property and share investments. Various exemptions apply, with the main one being the primary residence exemption. In contrast, non-residents investing in Australian only pay capital gains tax on Australian property. Taxable Australian property includes: A direct interest…

Objectives: Robert is a plumber and has recently lost tools due to theft at the building sites he works on. Robert purchases a dog to take to work for companionship, and to also protect his tools. Facts: Incurs $900 buying the dog and $600 training fees. Incurs $1,200 per year for food and…

A captive insurance company is where a parent group creates its own licensed insurance company to provide coverage for itself. The benefits of this include reduced costs, ability to insure difficult risks, direct access to reinsurance markets, and increased cash flow. In addition, when a company creates a captive they are indirectly able to evaluate…

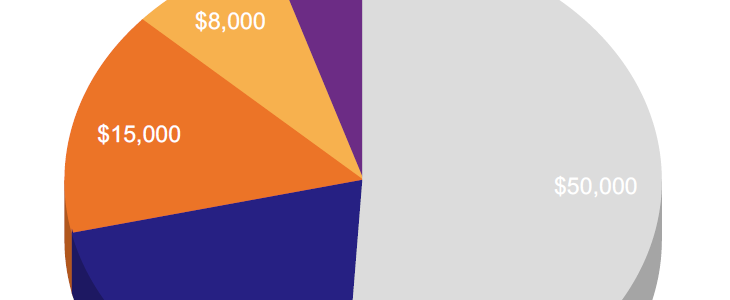

This strategy involves selling your business and paying no tax. This strategy only applies to businesses that pass either the $2 million turnover test or the $6 million net assets test. The three tax strategies that can achieve this are listed in the order of their attractiveness: 15 Year Small Business CGT Exemption. Retirement Exemption…

Double taxation is the levying of tax by two or more jurisdictions on the same declared income, asset or financial transaction. It may occur where a business or individual who is resident in one country makes a taxable gain in another country. Most countries, including the US and Australia, tax their residents on their worldwide…

Average weekly pay: $1,346 Employment size: 206,600 Future growth: Strong Skill level Bachelor degree or higher Advertising and marketing…

New report – Deluxe Tax Savings Report. The deluxe tax savings report includes all the benefits of the premium tax savings report plus reporting on tax summary, original income and net worth (the assets and liabilities for each group member). New database – Occupation Database. The occupation database explains both the typical, and unusual, tax…

A bachelor tax is a tax imposed on bachelors. The historical motives for imposing a bachelor tax have varied greatly from encouraging marriage, encouraging population growth, penalising delinquent and irresponsible bachelors, to simply raising government revenue. As Oscar Wilde (Irish Novelist and Poet, 1854-1900) said, ‘Rich bachelors should be heavily taxed. It is…

The tax systems of most OECD and developed countries are very similar. Generally, individuals who are deemed to reside in their country will be tax residents and taxed on their worldwide income. For example, an individual is an Australian tax resident if they either reside in Australia or satisfy one of three statutory residence tests…

There is no universal or legal definition of foundation. A foundation can be a trust, company, or other entity; and be either not for profit, or for profit. A foundation can be established under a will, by an individual, family, company or the community. Liechtenstein is one of the few countries which allows a private…

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2