Australia’s First Taxes – Excise and Customs Duties (1813)

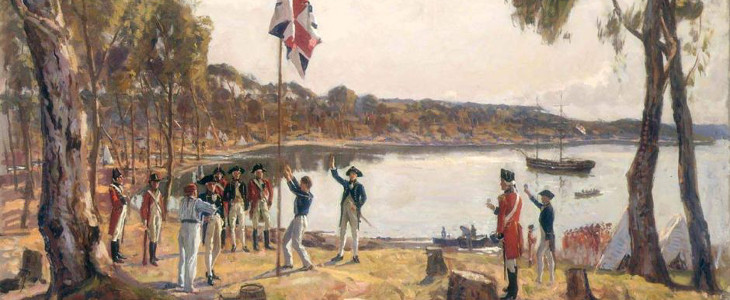

The English navigator James Cook became the first European to map the east coast of Australia in 1770 and a First Fleet of British convicts followed to establish a penal colony at Sydney in 1788. When the first Governor, Governor Phillip, arrived with the First Fleet he had a Royal Instruction that gave him power to impose taxation if the colony needed it. In the earliest days of the New South Wales colony there were no taxes as the convicts had no income of course and the free settlers were not generating enough wealth to enable any tax to be levied.

From 1813, customs duties were imposed on major export products such as timber, wool, seal, seal skins and whale oil. The first taxes introduced into Australia’s colonies were customs and excise duties on predominantly wharfage fees, wine, beer, tobacco and spirits. These taxes were introduced as they were easy to administer and less likely to attract negative attention than direct forms of taxation.

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2