Create an investment plan

7 April 2021

Investing, although riskier than cash, can create wealth over the long term with a strategic investment plan.

Implementation and Cost

- Calculate your net worth using a net worth calculator.

- Figure out your short-term, medium, and long-term financial goals (e.g., retiring with a $1000,000 investment portfolio).

- Understand the risks of investment and consider your risk tolerance.

- Consider what type of investment plan you need based on your goals

- Short term – savings accounts, government bonds, term deposits.

- Long term – Super, shares, property, index funds.

- Income earning (dividend stocks), growth shares (growth stocks).

- Create your portfolio.

- Diversify industries, currencies, and shares to reduce your risk

- Monitor your investments over time.

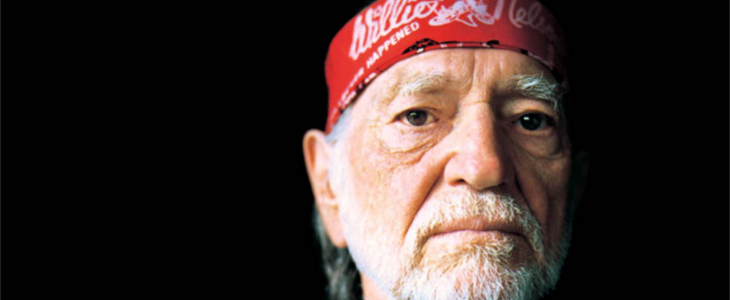

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2