Many accountants and business owners avoid it — not because it doesn’t work, but because of a few persistent myths that limit performance and growth. Myth 1: “Benchmarking is only for big businesses.” Truth: Benchmarking is actually more valuable for small and medium businesses. These businesses operate with tighter margins, smaller teams, and less room for error. They often…

After World War II, Deming travelled to Japan to teach manufacturers a revolutionary idea — that quality is measurable, and improvement is continuous. Through statistical process control, he showed companies like Toyota how to reduce variation, identify waste, and build excellence into every process. His philosophy of continuous improvement — later known as Kaizen — and his 14 Points for Management changed…

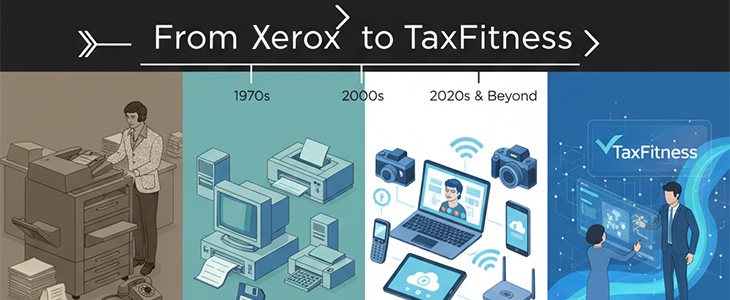

In the early 1980s, Robert C. Camp at Xerox faced a hard truth — Japanese competitors were producing higher-quality products at lower cost. Instead of guessing, he created a system. Camp developed the first formal benchmarking process, studying the best in the world to identify what they did differently and how to close the gap. His 1989 book, Benchmarking:…

It’s not just clinical expertise—it’s how they run the business of healthcare. Top 20% Benchmarks Annual revenue: $950,000+ Net profit: 15%–20% Consultations per practitioner: 22–30 per week Client retention: >80% Revenue per FTE practitioner: $250,000+ Billings per square metre: >$2,000/sqm annually High performers know: efficiency, retention, and financial discipline are as important as the therapy itself. Advisory insights…

It’s not just about installing more alarms. The best in the industry build businesses that are profitable, resilient, and recurring. Key Top 20% Benchmarks Annual revenue: $1.2m+ Net profit margin: 15%–20% Recurring monitoring income: 15%–25% of total revenue Quote conversion rate: 65%–75% Technician utilisation: >85% Average job value: $2,000–$2,500 The lesson is clear: recurring revenue, efficiency, and…

The Top 20% benchmarks are built on a methodology accountants can stand behind with absolute confidence. This isn’t theory—it’s science, discipline, and integrity combined. Multiple sources, not one dataset Government data. Industry surveys. Financial reports. Practitioner feedback. No single dataset is ever enough—we triangulate across them all so the numbers reflect the reality of the market, not a distorted…

Benchmarking is not new. For centuries, armies compared tactics, merchants compared trade routes, and artisans compared techniques. But benchmarking as a formal business discipline truly began in the 1980s — and it started with Xerox. In the early 1980s, Xerox was under siege. Japanese copier manufacturers like Canon and Ricoh were producing faster, cheaper, and better machines.…

Air conditioning, heating and refrigeration (often called HVAC) businesses aren’t guessing—the top 20% run on data. Accountants are uniquely placed to turn that data into action. Top-20% targets at a glance Revenue bands: small $500k–$1.2m · mid $1.2m–$3m · leaders $3.5m–$5m+ COGS 27–33% · Subcontractors 10–12% · Rent 2–5% Wages 20–25% · Overheads 8–13% · Owner’s salary…

But let’s be clear: accountants are uniquely positioned to own it. You sit on the data, understand the numbers, and are trusted with the complete financial story. Everyone else guesses from the outside. Compliance is being commoditised. Software is eating it. “Advisory” can sound like a buzzword—until you anchor it in benchmarking. Benchmarking makes advisory tangible,…

It came from a simple frustration: Most small business owners work incredibly hard… but too often without the direction, data, or support they need. For over 20 years, I’ve worked with small business clients and accountants across Australia. One truth became clear: “Small business owners need help to improve performance — but they’re not getting it from…

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2