Capital city: Vienna Currency: Euro (€) Population: 8.7 million Language: Austrian & German GDP …

It is good practice to review the prior year’s tax returns of all new clients to see whether any allowable deductions have been omitted from the return. If allowable deductions have been omitted (and can be substantiated) and the time limits on income tax amendments are met, the prior year’s returns can be amended. The…

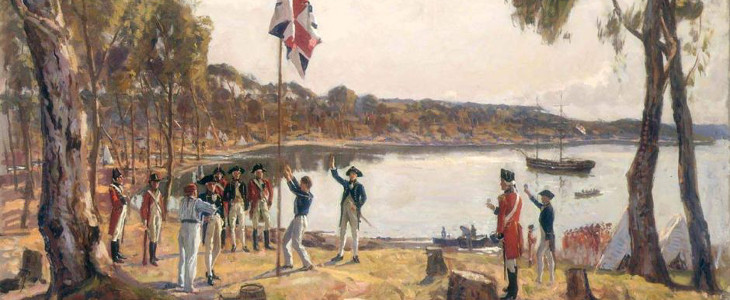

The English navigator James Cook became the first European to map the east coast of Australia in 1770 and a First Fleet of British convicts followed to establish a penal colony at Sydney in 1788. When the first Governor, Governor Phillip, arrived with the First Fleet he had a Royal Instruction that gave him power…

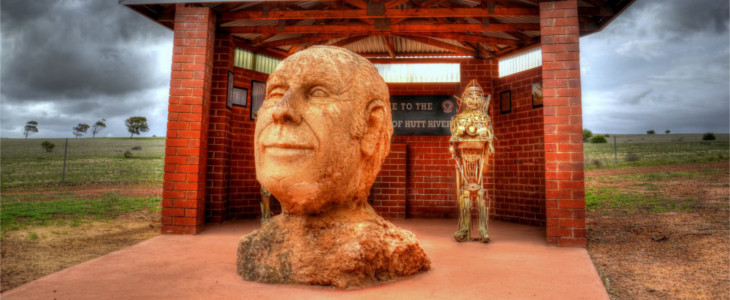

Capital city: Nain Currency: Hutt River Dollar Population: 23 Language: English & French GDP …

Benefits provided to employees of religious institutions in respect of pastoral duties or other duties or activities directly related to the practice, study, teaching or propagation of religious beliefs is exempt from FBT. The FBT exemption applies where: A religious practitioner is an employee of a registered religious institution. A benefit is provided to the…

As the well-known Australian billionaire media magnate Kerry Francis Packer once said in reference to the Australian government, ‘Now of course I am minimising my tax and if anybody in this country doesn’t minimise their tax they want their heads read because as a government I can tell you you’re not spending it that well…

Capital city: Saint Helier Currency: Pound sterling (GBP) Population: 100,080 Language: English & French GDP …

Employee meal costs, like lunch during a normal work day, are normally private non- deductible expenses. But an employer can provide the following meals to employees, claim a tax deduction for the expenses, and pay no fringe benefits tax: • Tea, coffee and cakes provided on business premises for employees and customers. • Sandwiches, muffins,…

We aim to create Australia’s largest and most comprehensive Tax Strategy Database, and we want your help to do it. As tax planners we want the largest database possible as that provides us with more ‘tools’ to help our clients legally save more tax. If you know of any good tax strategies that are…

Income tax was first implemented in Great Britain by William Pitt the Younger in his budget of December 1798 to pay for weapons and equipment in preparation for the Napoleonic Wars. Pitt’s new graduated (progressive) income tax began at a levy of 2 old pence in the pound (1/120) on incomes over £60 (£5,696 as…

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2