Stay informed about our software and resource upgrades over the last 12 months: November 2024: HECS debt repayment calculations. Primary production averaging calculations. Medicare levy surcharge calculations. DIV 293 tax calculations. Reports now include detailed tax calculations for individuals. September 2024 Ability to simplify our reports by omitting sections. August 2024 New annual premium subscription…

We have three new powerful resources designed to support your tax planning and business advisory journey: 1. Annual subscription premium This comprehensive package is your ticket to tax planning and business advisory success: Expert coaching and mentoring: Personalized guidance to help you grow your practice. Proven software and marketing tools: Streamline your workflow and attract new clients.…

We are pleased to announce a new annual subscription option incorporating software, marketing, resources and training. Key features include: 12-months software. Self-paced tax planning course (valued at $660). Webinars. Marketing resources. Annual cost $1,200 (plus GST). It’s our way of helping you get the most out of our software by providing resources that help you…

We are pleased to introduce our 1-day business benchmarking course. After just 1 day you can start generating extra fees from within your current client base. Simple, straightforward and income-producing. Tired of courses that are purely information? Well, this course is designed to get participants making money for your business quickly by making the theory…

We are excited to announce the launch of our fee generating tax planning and business advisory courses. Key features include: Targeting a minimum of $100,000 in tax planning and business advisory fees within the first 12 months (Platinum course). Unlimited phone calls and emails. Unlimited one-on-one coaching/mentoring (Platinum course). Access core course content (videos, checklists,…

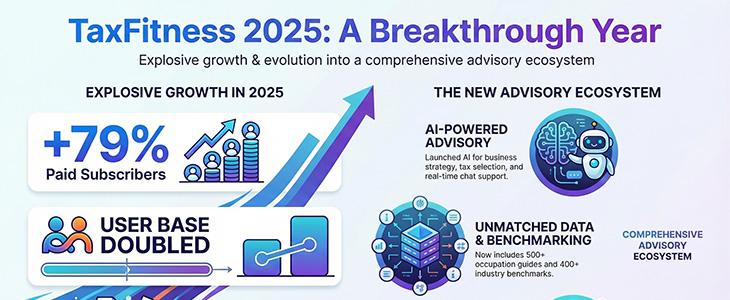

We have made some significant improvements to our TaxFitness software: You can now analyse up to 5 different scenarios when preparing tax planning reports. We have Improved the tax planning report design, presentation, and wording and included additional graphs and tables. Sixty new compliance and business advisory recommendations have been added to our tax strategy…

According to a study by the Australian Securities and Investments Commission (ASIC), around 50% of Australian adults do not have a will. In Australia, if a person dies without a valid will, their estate is considered intestate. Intestacy laws then come into effect to determine how the deceased person's assets will be distributed. The specific…

We are very excited to let you know that you can now import your clients' financial data from Xero (Over 700,000 Australian small businesses use Xero). TaxFitness subscribers can: Sync Xero clients and client groups with TaxFitness. Import Xero client financials for group members. Tax planning is now easier than ever for our subscribers. Follow our step-by-step Financials…

Australian tax planning software company TaxFitness now brings professional tax planning reports to Xero accountants in Australia. TaxFitness has today announced an integration with global small business platform, Xero. Accountants can securely sync Xero with TaxFitness and utilise over 200 up-to-date tax planning strategies to produce professional tax planning reports for their clients. Compliance fees…

Xero integration is coming to TaxFitness! Soon you will be able to import data from Xero directly into the TaxFitness software.

"You can’t improve what you don’t benchmark"

- W. Edward Deming