You don't have time to market your services to your clients and contact list. Our automated client newsletter does all the hard work for you: We write the content. We send the campaigns. Just sit back and watch the phone ring! Here are 5 ways to use our automated newsletter: Fully automated – Simply sign up your…

Our new WealthGenerator Report increases profitability, value & saleability by analysing a businesses current performance and providing solutions and options to optimise results. Who can benefit Business owners who want a more profitable and valuable business and have the discipline to make the changes required to optimise results. Trial our WealthGenerator Report now!

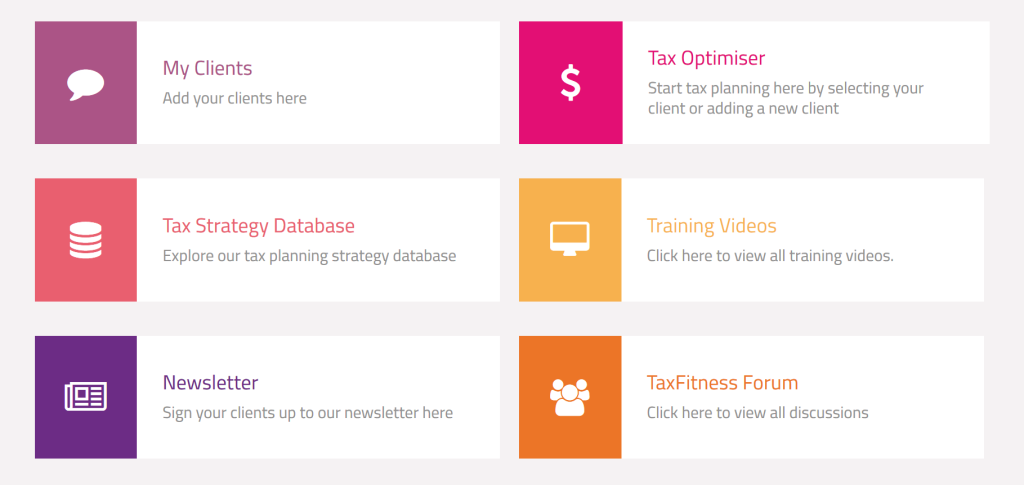

Our Taxfitness tax strategy database now boasts 250 tax strategies to help your clients structure their affairs to legally reduce their tax liability and make savings. The database explains how 250 different tax strategies actually work (i.e. what the tax strategy is, when to use the strategy, average tax deductions created by the strategy, and the strategy…

34 practices in Melbourne and Perth have just completed our Tax Planning Made Simple Workshop. The workshop teaches practices how to add a tax planning division to their practice in only one day. Although tax planning generates $330 million of fees pa, less than 1% of practices outside the top 100 generate any tax planning revenue. …

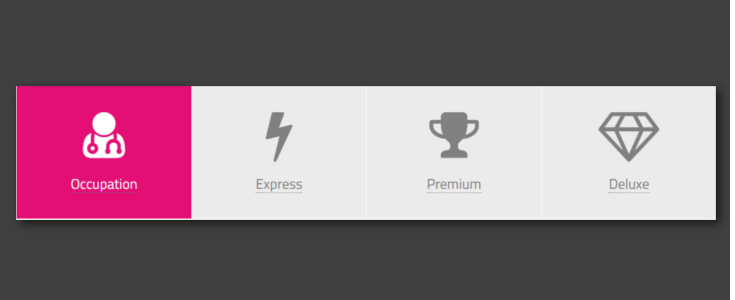

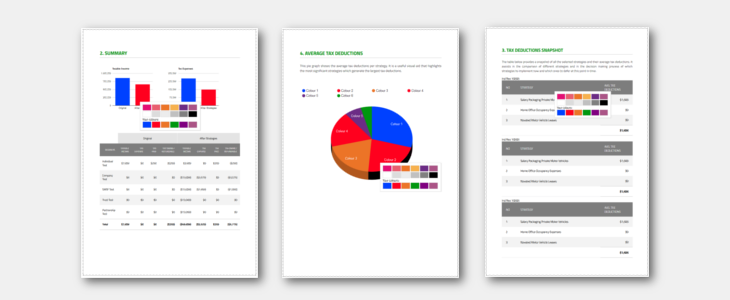

We are pleased to announce that TaxFitness has been upgraded to include new features and functionality. October Release Highlights: Improved usability – A new menu layout and design which makes the software easier to use. New report – Occupation Deductions Report. This report explains the typical, and unusual, tax deductions that apply to the…

New report – Deluxe Tax Savings Report. The deluxe tax savings report includes all the benefits of the premium tax savings report plus reporting on tax summary, original income and net worth (the assets and liabilities for each group member). New database – Occupation Database. The occupation database explains both the typical, and unusual, tax…

New Report – Express Tax Savings Report The express tax savings report enables you to generate a client tax savings report in only 5 minutes. It is as simple as selecting the strategies applicable to the client and clicking the express button. Step 1 – Enter Client Data Set-up the client and enter the…

February Release Highlights: Option to remove TaxFitness logo and branding (for the tax savings report). Practices can customise all colours in the tax savings report to match their practice branding. Full colour palette available. 8 tax strategy filters added: Employees, Investors, Businesses, Buying/Starting a business, Selling a Business, Capital investment Rental properties, SMSFs. The 4…

We are excited to announce a new and advanced / improved / upgraded version of TaxFitness! Branding You can now remove the TaxFitness logo and branding from your Tax Savings Reports and add your own brand colours quickly and easily as a practice manger from My Practice. Integrated Mud Map We have integrated the Client…

We have updated our software in September with increased usability and some new features. September updates now live: Tax Agent Directory – Now includes office locator. TaxFitness Newsletter – Practices can now personalise the newsletter by adding their own content (if they wish). My Subscribers migrated to My Clients – Practices need only maintain…

- « Previous

- 1

- 2

- 3

- 4

- Next »

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2