Scan 50 accounting firm websites. You’ll see: Business advisory. Strategic advice. Helping you grow. Inside the firm? Still compliance. Here’s the truth. Most firms claiming advisory: Have no system No defined process No structured deliverables No modelling tools No pricing framework No supporting software It lives in the partner’s head. If you can’t: Run it…

When salary return numbers drop, the obvious question is: “Where does that revenue get replaced?” For some firms, it won’t be. If your firm’s value is tied to checking receipts and lodging forms, there’s no natural upgrade path. The work just disappears. But for firms that understand advisory, the shift is straightforward. The $1,000 standard…

Most wreckers chase volume. More cars. Bigger yard. Longer days. Top-20% wreckers focus on profit per vehicle. Here’s what the data shows. Top-20% Auto Wreckers Revenue: $1.1m – $1.4m COGS: 30% – 35% Wages: 20% – 30% Net profit: 15% – 20% Parts sales: 75% – 85% of revenue Inventory turnover: 2.5x – 4x Quote conversion: 50% – 65% Same industry. Same cars.…

From 1 July 2026, the ATO is introducing a $1,000 standard work-related deduction. If a client’s deductions are $1,000 or less, they can claim it without receipts. If they’re over $1,000, nothing changes. Records still matter. Advice still matters. This change doesn’t make accountants redundant. It exposes where time has been wasted. Chasing receipts for basic deductions…

Too many accountants ask me the same question: “How do we actually turn tax planning and advisory into real revenue — not just nicer reports?” Here’s the honest answer. Software alone doesn’t do it. Neither does a one-off webinar or a template download. What works is guided execution, applying the work with real clients, refining it,…

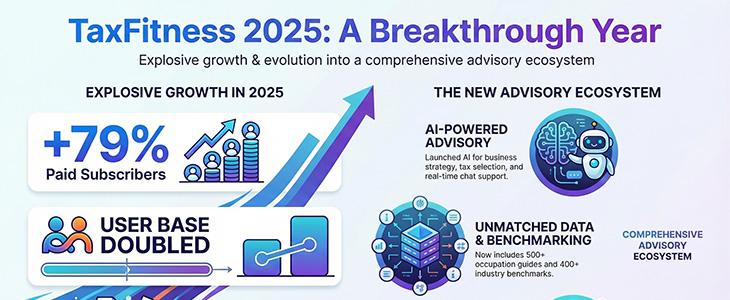

Most accountants underestimate one of the easiest wins sitting right in front of them: Occupation-specific tax advice. Generic deduction lists don’t cut it anymore. Clients want clarity, not guesswork — and they want to know you understand their world, not just “tax rules”. That’s why we built the TaxFitness Occupation Deductions Database — now covering…

As we close out 2025, I wanted to share where TaxFitness has landed and, more importantly, where we’re heading. This year has been the biggest step forward we’ve taken since the platform launched. Not just more users. Not just more features. A genuine shift in how accountants deliver advice. 𝗛𝗲𝗿𝗲’𝘀 𝘁𝗵𝗲 𝘀𝗻𝗮𝗽𝘀𝗵𝗼𝘁: Paid subscribers up…

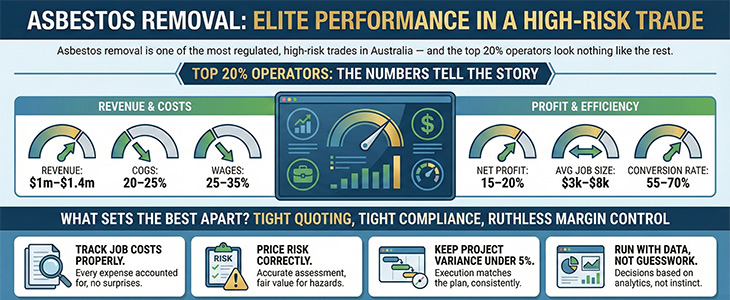

Asbestos removal is one of the most regulated, high-risk trades in Australia — and the top 20% operators look nothing like the rest. Their numbers tell the story: Revenue: $1m–$1.4m COGS: 20–25% Wages: 25–35% Net profit: 15–20% Avg job size: $3k–$8k Conversion rate: 55–70% What sets the best apart? Tight quoting, tight compliance, and ruthless…

Most accountants know the name Philip Crosby — the man behind “zero defects” and the famous line: “Quality is free.” It sounds bold, but Crosby was right. Doing things properly the first time is always cheaper than fixing mistakes later. Every practice owner has learned that lesson the hard way. But here’s the part that often gets missed:…

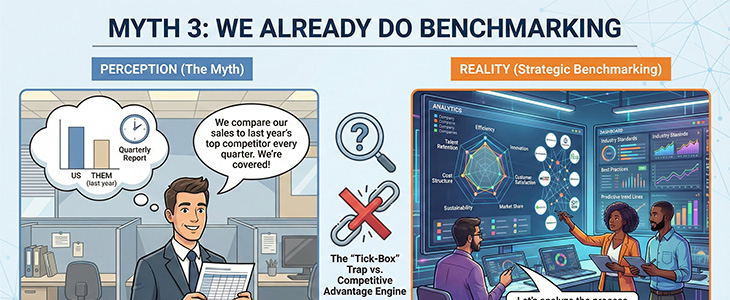

I hear this every week from accountants. And here’s the truth: KPIs on their own are just numbers. They only become meaningful when compared to a higher standard. W. Edwards Deming said it best: “No process is ever good enough unless it is compared to a higher standard.” Most firms track KPIs in isolation: Gross…

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2