At Federation in 1901, the Australian Constitution granted the Commonwealth a monopoly of customs duties and excises and the power to levy other taxes concurrently with the States. One of the significant results of Federation was the removal of all duties on goods traded between Australian states. By Federation, many of the colonies had introduced…

Capital city: Monrovia Currency: Liberian dollara (LRD) Population: 4.7 million Language: English GDP …

A remote area housing benefit is an exempt benefit under section 58ZC of the Fringe Benefits Tax Assessment Act 1986. If a housing benefit is deemed a remote area housing benefit the employer can claim a tax deduction for the employees housing costs, and no FBT is payable. This converts an employee’s private housing…

Tasmania was the first state to introduce an income tax in 1880 to raise revenue due to a fiscal crisis. The tax took the form of a withholding tax on distributed income of companies. In 1884, a general tax on income was introduced in South Australia, and in 1895 income tax was introduced in…

Capital city: Carson City Currency: US dollar Population: 2.94 million Language: English GDP …

The advantages of operating a business through a company include: 30% tax rate (standard company tax rate) 27.5% tax rate for companies with a turnover less than $10m pa. (The turnover thresholds increase to $25m in 2017/18 and $50m in 2018/19). By 2026/27 the company tax rate for companies with a turnover less than $50m…

The first direct taxes took the form of taxing the estates of deceased persons which at the outset applied only to personal estates and not real estate. The first death duty was applied in 1851 in NSW, 1865 in Tasmania, and eventually all the other states by 1901. The rates were progressive and based on…

Capital city: Victoria Currency: Seychellois rupee (SCR) Population: 92,000 Language: English, French & Seychellois Creole GDP …

When a motor vehicle is used 100% for private purposes there is normally no tax deduction available on the expenditure. With this strategy an employee can generate annual tax savings of $2,500 – $3,000 pa by salary packaging their private motor vehicle with their employer. The tax savings result from the motor vehicle tax concessions…

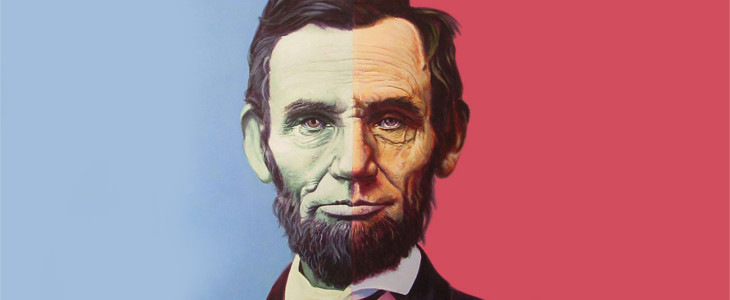

The US federal government imposed the first personal income tax, on August 5, 1861, to help pay for its war effort in the American Civil War – (3% of all incomes over US$800). It was only in 1894 that the first peacetime income tax was passed through the Wilson-Gorman tariff. The rate was 2% on…

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2