Martha Helen Stewart (c1941) is an American businesswoman, writer, and television personality. As founder of Martha Stewart Living Omnimedia she has gained success (a net worth of US$638 million) through a variety of business ventures, encompassing publishing, broadcasting, merchandising, and e-commerce. She has written numerous bestselling books, is the publisher of the Martha Stewart Living…

An intellectual property box regime is a special tax regime for intellectual property revenues. It is also known as a patent box, innovation box or IP box and was first introduced in 2000 by the Irish as a reduced rate of tax on revenue from IP licensing or the transfer of qualified IP. In Europe…

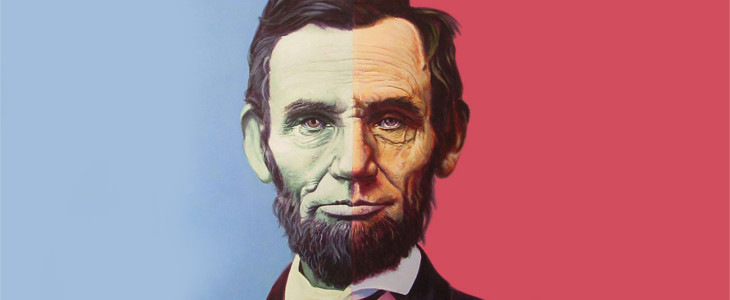

The US is the world’s largest economy with a gross national product (the value of all goods and services produced) of $18.5 trillion. The US accounts for a massive 24.5% of the world economy. The election of Donald Trump as President of the US will bring many changes. Probably none more so than his promise…

The double Irish tax strategy has been used since the late 1980s by some multinational corporations (including Apple, Google, Microsoft and Facebook) to lower their corporate tax liability. The strategy uses payments between related entities in a corporate structure to move income from a higher-tax country to a lower or no tax jurisdiction. It relies…

The Singapore Sling is a gin-based cocktail from Singapore that was developed in 1915 by Ngiam Tong Boon, a Hainanese bartender working at the Long Bar in Raffles Hotel, Singapore. It was initially called the gin sling – a sling was originally an American drink composed of spirit and water, sweetened and flavored. BHP Billiton…

Have 5 different Tax Planning leaflets on display in the reception area of your office. Some clients will then pick them up and read them while waiting for their appointment. The leaflet series details tax planning options for: Rental Property Owners, Small Business Owners, Buying/Selling/Starting a Business, Employees, Investors and Retirees. Include a Tax Planning…

- « Previous

- 1

- …

- 5

- 6

- 7

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2