A hybrid trust is a particular type of trust that combines the best elements of a discretionary trust and a unit trust in the one entity. This structure is useful for holding capital growth and income-producing assets such as rental properties. The advantages of a hybrid trust are: Can save tax by streaming different types…

Capital city: Ngerulmud Currency: United States dollar (USD) Population: 21,503 Language: …

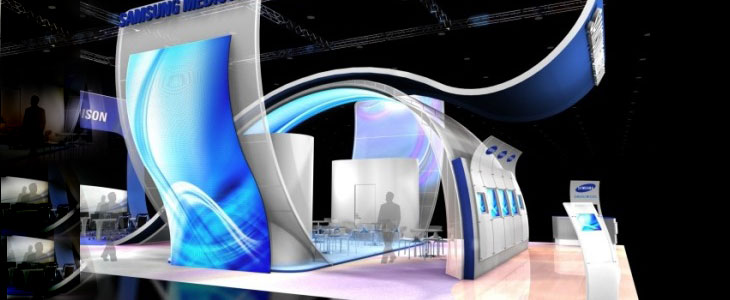

A trade show or exhibition is an exhibition organised so that companies in a specific industry can showcase and demonstrate their latest products and services, study activities of rivals and examine recent market trends and opportunities. The benefits of trade shows: Improves awareness – It helps build the brand, knowledge of products, and enhances name…

Co-existing work locations travel involves travel which can be attributed to the employee having to work in more than one location. This is the case where: The travel is directly between work locations, or between home and an alternative work location, and It is reasonable to conclude that the travel is undertaken in performing the…

Capital city: Muscat Currency: Rial (OMR) Population: 4,424,000 Language: Arabic GDP: …

A home unit company is a proprietary company whose sole function is to act as the body corporate of a block of flats or units. The company operates as a body corporate to administer the property and to facilitate, protect and enforce the rights of company members concerning the exclusive occupation of the residential areas…

Tendering is the process of choosing the best or cheapest company to supply goods or do a job by asking several companies to make offers for providing the products or doing the work. Tendering occurs in all parts of a business but is most familiar with government projects, construction, utilities, and infrastructure. Governments are heavily…

Where an employee undertakes 'special demands' travel between home and a regular work location, the trip will be deductible work-related travel where being conducted in performing the employee's work activities. Travel will be part of an employees work activities where: The work activities require the employee to undertake the trip. The employee is paid, directly…

Sponsorship can be defined as supporting a person or entity in one way or another as part of a business strategy. Sponsorship can achieve the following business goals: Image enhancement. Customer loyalty. Brand awareness. Lead generation. Increased sales. Creating positive publicity and heightened visibility. Keys to successful sponsorship: Clearly define your objectives – what are…

Capital city: Saipan Currency: United States dollar (USD) Population: 53,833 Language: …

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2