Reducing debt is easy in theory but exceedingly difficult in practice. We all need to borrow money at some point in our lives, whether it be to buy a house or start a business. Whilst debt leveraging can be a useful wealth-building tool, in most cases reducing or removing all debt will result in a…

Overview It sounds contradictory and counterproductive but paying yourself first can be a very effective personal finance strategy for wealth generation. Implementation Decide how much you would like to spend each weak on your self. Decide how much you need to save each week to reach your savings goals. When your money comes in, set…

An incorporated association is a formal legal structure adopted by a broad range of non-profit organisations. Incorporated associations have the word 'incorporated' or the abbreviation 'Inc' in their name. Incorporated associations are subject to state or territory incorporation laws and are administered to by a government body within the relevant state and territory. As a…

Taxation has existed for over 8,000 years. Mesopotamia, a historical region covering the Tigris–Euphrates river system, introduced a Bala tax in 6,000 BC. The taxes included livestock, fish, grain, labour and craft products. The idea of taxing income is a modern innovation and requires three things: a money economy, an accurate accounting system, and thirdly,…

The unique selling proposition (USP) is a marketing concept that states successful advertising campaigns make unique propositions to customers that convince them to switch brands. It is what makes your business unique and valuable to your customers. The term was invented by television advertising pioneer Rosser Reeves of Ted Bates & Company. Unique propositions…

A hybrid trust is a particular type of trust that combines the best elements of a discretionary trust and a unit trust in the one entity. This structure is useful for holding capital growth and income-producing assets such as rental properties. The advantages of a hybrid trust are: Can save tax by streaming different types…

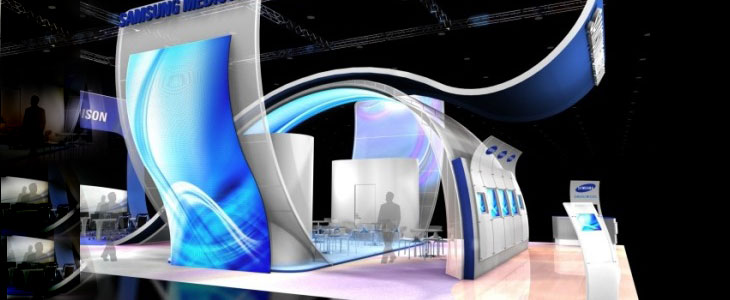

A trade show or exhibition is an exhibition organised so that companies in a specific industry can showcase and demonstrate their latest products and services, study activities of rivals and examine recent market trends and opportunities. The benefits of trade shows: Improves awareness – It helps build the brand, knowledge of products, and enhances name…

A home unit company is a proprietary company whose sole function is to act as the body corporate of a block of flats or units. The company operates as a body corporate to administer the property and to facilitate, protect and enforce the rights of company members concerning the exclusive occupation of the residential areas…

Tendering is the process of choosing the best or cheapest company to supply goods or do a job by asking several companies to make offers for providing the products or doing the work. Tendering occurs in all parts of a business but is most familiar with government projects, construction, utilities, and infrastructure. Governments are heavily…

Sponsorship can be defined as supporting a person or entity in one way or another as part of a business strategy. Sponsorship can achieve the following business goals: Image enhancement. Customer loyalty. Brand awareness. Lead generation. Increased sales. Creating positive publicity and heightened visibility. Keys to successful sponsorship: Clearly define your objectives – what are…

"You’d be stupid not to try to cut your tax bill and those that don’t are stupid in business"

- Bono: U2